How much data do you warehouse in spreadsheets, and is this best practice?

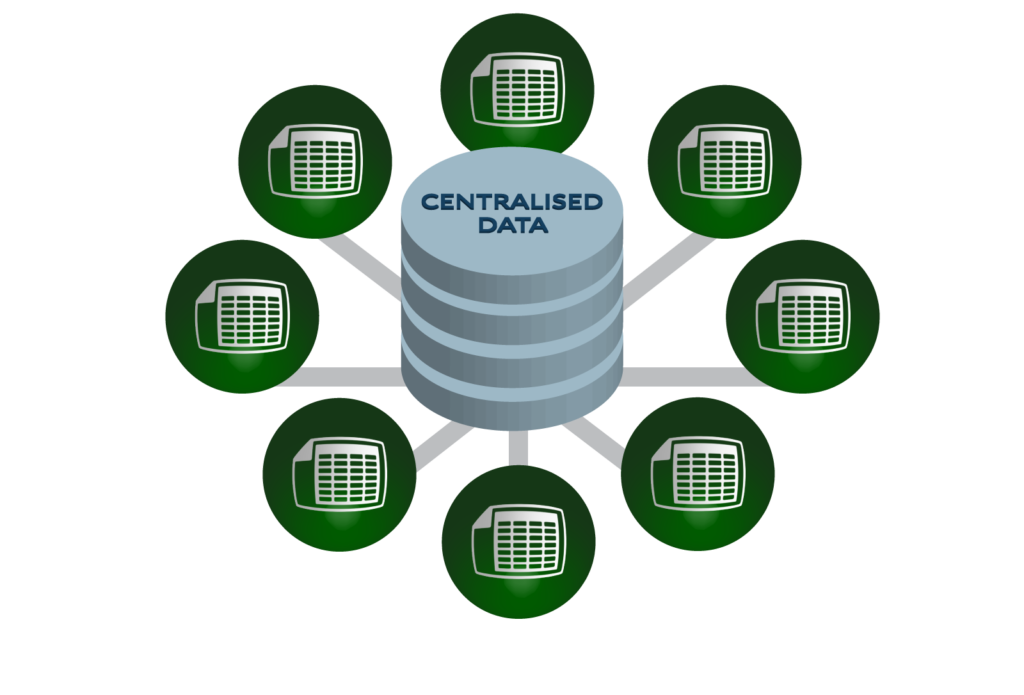

When analysts and portfolio managers store their research in spreadsheets, they create many inter-dependencies between these and other spreadsheets used in the investment and research process. This leads to duplication and unwanted complexity. What’s more, when the data in a spreadsheet is out of date or incorrect, errors can seep into the rest of the investment process.

Early in my career, I performed a data usage analysis for the research process of a large fund manager. I uncovered a situation where several key spreadsheets used on a daily basis depended directly and indirectly on data residing in one core workbook. A great deal of data was stored in this workbook. Unfortunately the person who had created and maintained that workbook had left the company six months previously. No one was updating the data, which meant that many of the dependent spreadsheets and reports were wrong. Furthermore, there was no way of knowing that this was the case, unless one actually checked all reports used in the process.

Quintessence removes these dependencies, but still allows you to work in Microsoft Excel®

It is an established fact that the majority of investment managers choose Microsoft Excel® as their preferred work tool. Most fundamental analysts use Excel®to mathematically model the companies that they research. Quintessence stores data in a central repository; consequently all Excel® workbooks can access this data using a handful of live functions. All spreadsheets access the same information, but without complex links and inter-dependencies. As a result, the data is accurate and identical across all workbooks. All role players have access to the same up-to-date data. When reports require changes, these can be made quickly and efficiently, with little or no involvement from IT.

What if someone’s research numbers are required by others?

Quintessence allows analysts to store the output of their models in the central repository by simply clicking one button in Excel®. This research is consequently accessible to others involved in the investment and research process. At various clients, analysts upload the ‘HEPS’ and ‘Forward PE’ estimates for the companies they research, on a quarterly basis. Using proprietary algorithms, this research is displayed to fund managers in the form of a ranking table. The ranking table is then used to establish the house view as per the fund manager’s input. In summary, Quintessence allows research to be stored and used in multiple facets of the investment and research process.

May your hindsight become your foresight

A key advantage of uploading research is that a history is maintained. In the example above, all estimates are stored with a declaration date. This allows for postmortems of all decisions made in the investment and research process to be performed at any time. Furthermore, the quant team can perform a ‘what-if analysis’ on this research data stored over time.

In summary

Quintessence allows research to be stored centrally and used in multiple facets of the investment and research process, without expecting users to leave Excel®.

Contact us for more information or read about Quintessence features.